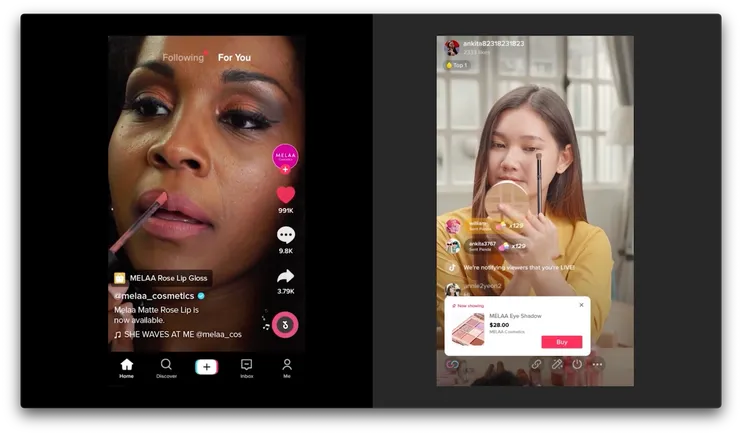

TikTok is seeking to launch its in-app buying instruments in Spain and Eire, because it ramps up its in-stream buying push in hopes of producing extra income from apps.

In line with a Bloomberg report, TikTok hopes to renew its EU buying push after a failed acceleration in 2022, setting off a much bigger push into these two markets.

In line with Bloomberg:

“[TikTok] In current weeks, companions together with retailers and manufacturing firms have been requested to arrange for a TikTok Store debut within the two nations, based on individuals accustomed to the matter. The rollout can be smaller than beforehand imagined though preparations are underway to convey the portal to different components of Europe subsequent yr.”

As famous, TikTok tried to make a extra important e-commerce push in Europe, coming back from the UK in 2022, however was pressured to push again that rollout attributable to inside conflicts.

The report means that TikTok’s troublesome working situations, Primarily based on its Chinese language operations, it was not effectively obtained amongst UK staff, finally resulting in the alternative of native administration. It then derailed its bigger ecommerce push, although lack of shopper curiosity was additionally a think about its determination to reduce.

However now, with in-app spending on the rise, TikTok sees a brand new alternative to attach with EU shoppers.

TikTok not too long ago reported that the app now has 15 million sellers, with TikTok now the second largest in varied markets, particularly within the UK On-line magnificence and wellness retailer.

So the chance is there, if TikTok can get it proper, and it’s now working to streamline its processes, and construct in-app spending habits to develop its ever-growing market share.

Though TikTok’s Chinese language sister app is just not rising on the charge it has seen in its homeland.

Douyin, the Chinese language model of TikTok, is alleged to hit over $300 billion in gross sales in 2023. By comparability, TikTok earned $3.8 billion throughout the identical interval.

What’s extra, Douyin’s gross sales quantity has grown quickly, and is anticipated to proceed to develop for a while.

As you possibly can see on this chart, Douyin earned $387 billion simply 4 years after gross sales of $5.8 billion in 2019. And when you think about that TikTok is at present value $3.8 billion, you possibly can see why father or mother firm ByteDance sees elevated alternatives, however on the similar time, Western audiences, basically, stay proof against social media commerce and have not proven the identical curiosity in in-stream purchases that There are Asian customers.

That is additionally mirrored in TikTok. TikTok customers inside Singapore, Malaysia and Indonesia is More and more take its buying initiative, however it’s nonetheless, apparently, a tough promote within the non-Asian market.

Why that is, nobody is aware of, however it appears that evidently many Western shoppers are much less concerned with buying inside social apps, and extra related to visiting devoted buying portals like Amazon for buying actions.

By the way: Not too long ago, TikTok launched its personal “Deal for You” occasion To compete with Amazon’s “Prime Day”. However it didn’t catch.

Reported by ModernRetail:

“For non-Amazon retailers, gross merchandise quantity development within the U.S. through the two-day interval of Amazon’s Prime Day gross sales was up 3% year-over-year. In distinction, whole merchandise development throughout TikTok’s Deal for You Days occasion from July 9 to July 17 was really a decrease 6%.“

Within the US, after all, TikTok’s potential hyperlinks to CCP might also trigger some backlash and concern amongst shoppers, with the US authorities imposing a compulsory sell-off invoice on the app.

That is prone to make some customers extra hesitant to add their cost data, though this can even lengthen to different Western areas, the place TikTok has come below scrutiny for its information sharing and utilization practices.

As such, it does not appear like TikTok will ever turn into an ecommerce powerhouse on the identical degree as Douyin. However it’s undoubtedly going to take effort, and whereas I am unable to think about it being a transformative change, there’s proof that TikTok can nonetheless turn into a significant retail presence and a significant model consideration, at the least in some sectors.

So will this new EU buying push ship large outcomes? Most likely not, however then once more, even small scale take-ups can nonetheless be important.