Snapchat launched its newest efficiency replace, displaying its advert enterprise continues to enhance, though its person development is displaying stronger indicators of stagnation and a doable limitation on its utilization.

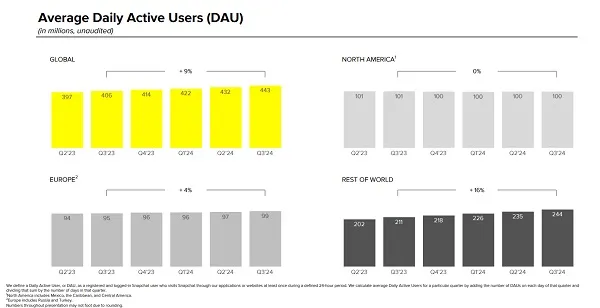

We’ll begin with that ingredient first. Snapchat added 11 million customers in Q3, with 443 million every day actives.

Which is a gradual improve, though as you’ll be able to see in these charts, there are some associated components in Snap’s development

The most important situation for traders shall be that North American DAUs stay flat at 100 million, the place they’ve sat for greater than two years now. It nonetheless has a major person base, in a serious market, and the truth that Snap has maintained it’s a constructive. However the stagnation right here highlights Snap’s ongoing development challenges, notably relating to the “getting old” individuals in Snap’s market. Because it occurs, the app has seemingly managed to interchange these customers. However the backside line is that it’s not growing its market share in its most established markets.

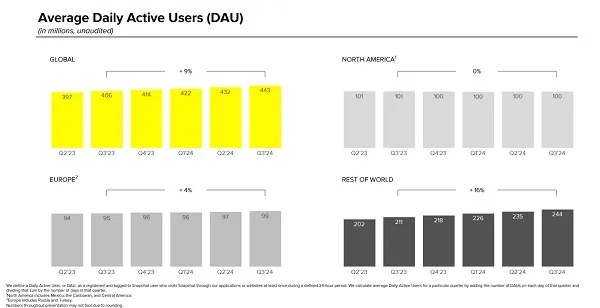

Which does not bode effectively for the prolonged scope, and whenever you take a look at its regional income per person figures, it additionally factors to an ongoing concern.

Snap nonetheless generates most of its income from its US customers, so it actually desires to see extra development there. That hasn’t occurred for a while, whereas its DAU development in Europe has additionally been minimal over the previous yr.

From an investor’s perspective, this might be seen as a possible plateau, provided that Snap, the market it has been in for the longest, has now hit a transparent cap on its development potential. Older customers swap off, youthful customers are available, however Snap is seemingly at its restrict, not less than based mostly on final yr’s information.

It is not definitive, after all, and Snap should discover new methods to draw new customers. However it seems to be like we’re beginning to see Snapchat’s potential attain, development continues to be coming within the “remainder of the world” class, however it may attain the identical restrict.

This may undoubtedly scare the market, because it places a transparent restrict on the expansion of Snap’s advert enterprise.

Snap is making an attempt to handle this by reformatting the app with a extra simplified, streamlined UI to make it extra welcoming to new customers.

And up to now, Snap says the revised UI is working effectively amongst these with entry:

“Broadly talking, “Easy Snapchat” is gaining the best content material engagement amongst extra informal customers, which is a vital enter for neighborhood development and promoting stock. We’re seeing notably constructive results on Android units, together with time spent with content material, elevated story views, and extra replies to pals’ tales. We’re additionally seeing a rise in content material energetic days on iOS, however the results on different high engagement metrics are nonetheless not as massively constructive as on Android resulting from variations in engagement throughout these platforms.”

So the up to date format is seemingly serving to extra adoption amongst new and informal customers, which is a constructive pattern. However nonetheless, Snap stays hesitant in regards to the full roll-out of the replace:

“Whereas we consider development in content material engagement and demand for brand spanking new advert placements might improve over time, most of the adjustments related to Easy Snapchat happen instantly as Snapchatters transition to the brand new person expertise, which presents the danger of near-term disruption. Whereas we at the moment do not count on a broad roll-out of straightforward Snapchat in our most extremely monetized markets till Q1, we’ve now begun restricted testing in these markets and should broaden this testing additional as we transfer via This autumn.”

In different phrases, whereas the long-term engagement outcomes look constructive, the fast backlash from customers may see nearly all of US and EU customers turning off, and Snap is not able to take the danger on a bigger scale simply but.

However maybe, in the end, it can current one other means for Snap to take away its utilization development cap.

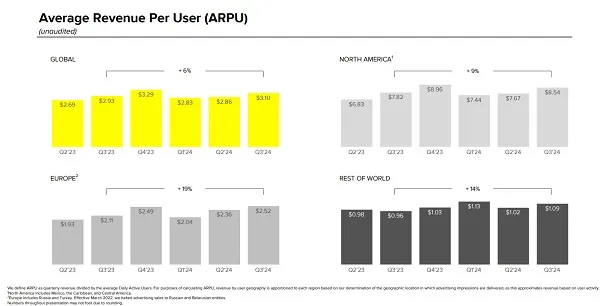

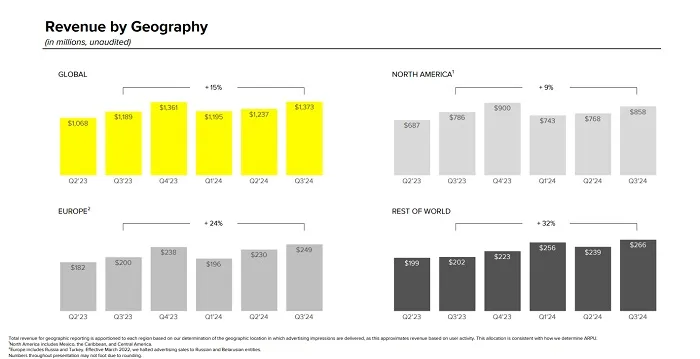

When it comes to income, Snap introduced in $1.37 billion in Q3, a 15% year-over-year improve.

Snap says its direct response merchandise are seeing constructive suggestions from advertisers, whereas it is attracting extra SMB advertisers to the app.

Snap can be experimenting with new advert codecs, together with “Sponsored Snaps”, which is able to see advertisements inserted into the app’s person’s inbox for the primary time. Which I do not assume shall be overly appreciated, however once more, with its utilization development seemingly restricted, one thing needs to be achieved to broaden its income scope.

That is the place the true squeeze is available in, the place Snap is pressured to search out extra promoting alternatives, wherever it may possibly, whereas not alienating audiences that promote an excessive amount of.

Once more, a cap on development in its core market is a trigger for concern.

When it comes to utilization tendencies, Snap says complete time spent watching content material on the app grew 25% yr over yr, whereas “Highlight,” its TikTok-like short-form video feed, has greater than 500 million month-to-month energetic customers. , on common, in Q3.

Snapchat+ additionally continues to develop, with 12 million customers now paying month-to-month charges for varied add-ons to the app. Snapchat mentioned it reached 11 million paying customers in August, so it added an extra million subscribers in simply two months.

In comparison with different subscription choices from the social app, Snapchat+ has been an enormous success, with X even struggling to achieve 1.3 million X Premium sign-ups regardless of each choices launching across the similar time. As all the time, Snap has proven that it is aware of its viewers and what they need from the app, which has enabled it to offer extra choices to entice Snapchat+ sign-ups.

That is still a minor part when it comes to income (Snapchat made greater than 90% of its income from promoting throughout that interval), however it’s one other indicator of Snap’s enduring reputation amongst its devoted customers and the app’s endurance, particularly amongst youngsters. .

One other space of concern for Snap, although, might be its capacity to proceed investing in larger-scale initiatives like its AR glasses if its development is certainly restricted.

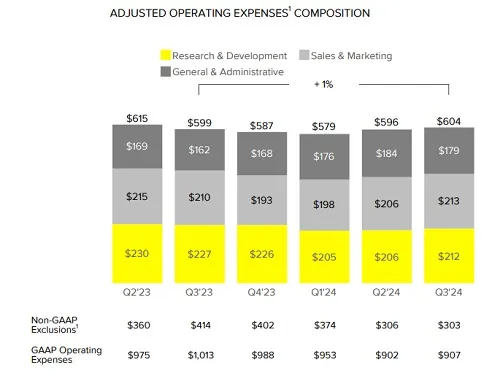

As a result of when taking a look at Snap’s prices, its “analysis and improvement” prices are beginning to rise once more.

Snap says it is inching additional right into a ramp of ML and AI funding, after Snap has saved issues comparatively below management on this entrance, and Snap might want to make investments much more earlier than AR glasses attain shoppers in just a few years.

With out that funding, the entire undertaking would fall flat, so Snap will want shareholder religion to take that leap. Nonetheless, whereas Meta additionally places its AR glasses on the identical timeline, it additionally looks like Snap goes to wrestle to realize acceptance for its AR units anyway, as based on our assessment of Snap’s AR units vs. Mate’s Orion glasses, the Mate’s AR glasses, of their present type, are approx. Superior to Snap in all respects.

I am unsure I see a future on this undertaking, particularly given these numbers, as Snap merely does not have the sources to compete and might be blown out of the water by the Mate system after launch both means.

Though it’s also attention-grabbing to notice that Snap has initiated a $500 million share buyback program as a part of its outcomes announcement. This may occasionally scale back the pool of potential objectors to its AR plan.

Snap nonetheless has alternatives in worldwide markets, and its enhancements and growth of promoting choices are paying off. However as talked about, I might be involved about its stagnant development, and what that may imply when it comes to the app’s potential saturation level.

As a result of when you attain that wall, your solely remaining development lever is, principally, extra promoting.

And churning via an ever-changing core base of youthful customers will push Snap nearer to shedding its viewers.

You may view Snap’s full Q3 2024 outcomes right here.