Meta shared its newest efficiency replace, which exhibits a small improve in energetic customers throughout its apps and a big improve in income in relative phrases.

Nevertheless, its funding in later stage initiatives stays important. This is a have a look at the newest numbers from Mark Zuckerberg’s tech behemoth

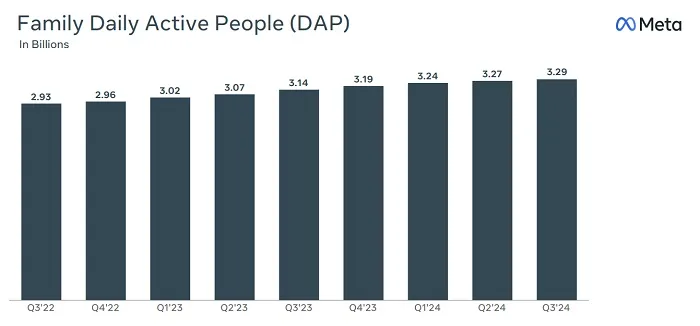

First, on energetic customers. Meta reported that it now has 3.29 billion individuals utilizing its apps (Fb, Messenger, WhatsApp, Instagram, and Threads) day by day, a small improve from the three.27 billion it reported in Q2.

Though we’re speaking about 3 billion plus individuals, the dimensions of which is absolutely laborious to fathom.

The world inhabitants is estimated to be round 8.1 billion, so Mater apps are utilized by round 40% of the whole planet each single day. Minus the 1.4 billion Chinese language residents (the place Meta is banned), and that is nearer to 50%, so the breadth of Meta operations on this sense is fairly wonderful.

And it is nonetheless rising. Whereas its apps have probably reached saturation level in lots of markets, Meta remains to be seeing signups for its apps, which bodes nicely for its ongoing prospects and its core promoting enterprise.

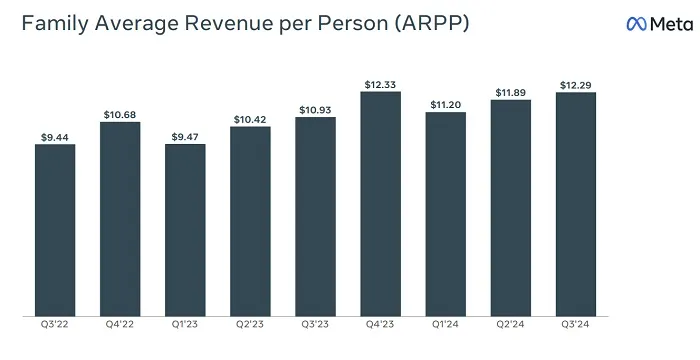

The truth is, Meta drives extra income on common from these customers:

Meta would not escape its ARPP outcomes by market prefer it used to, however as you possibly can see right here, Meta’s general income per person is rising, and can decide up once more amid the vacation rush in This autumn.

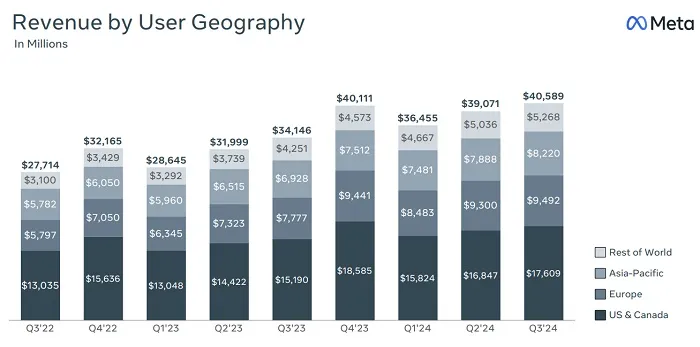

Which is able to assist Meta proceed to enhance its income assortment:

As you possibly can see on this chart, Meta stays depending on North America and Europe for many of its income, though additionally it is steadily rising its Asia Pacific market.

It was seen posting a powerful income end result for the interval of $40.59 billion.

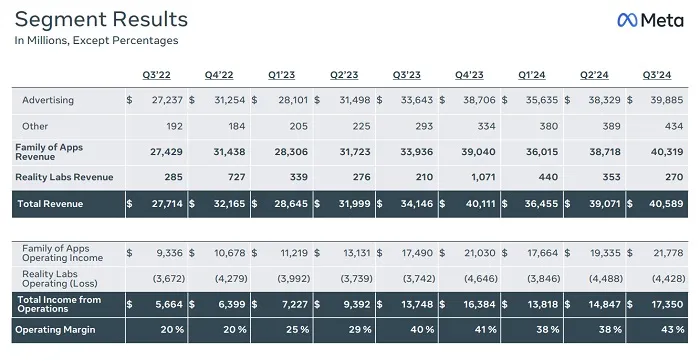

So whereas Meta is spending a silly quantity on VR and now AI growth, it continues to money in on its major money cow by displaying individuals extra advertisements on its app.

On that entrance, Meta additionally reported that advert impressions delivered throughout its app grew 7% year-over-year. Common price per advert can also be rising (+11% YoY), though the mathematics might be not splendid for social media entrepreneurs.

Mainly, because of this Meta is serving extra advertisements to extra customers in additional locations. Which suggests extra alternatives for entrepreneurs to succeed in their target market, however as an alternative of lowering advert costs by including extra placements, it really sees them improve. I can see why it is a constructive for Mater shareholders and its backside line. However for advertisers, not a lot.

This might enhance as extra individuals undertake Meta’s Benefit+ automated advert campaigns, which totally automate advert placement, artistic, even budgeting and bidding in the event you choose. Meta says these advertisements are delivering higher outcomes by way of improved behavioral understanding, and not less than in concept, might assist entrepreneurs optimize their advert supply and scale back general prices.

Or worth dearer advertisements and ship higher outcomes

So, extra customers, including to its already huge presence and extra advert income, which, as talked about, is ready to select up once more in This autumn. The whole lot appears to be going fairly nicely for Zuk and co.

Oh, apart from this:

Meta continues to lose cash on VR and AI growth, with its complete prices and bills rising by 14% 12 months over 12 months.

And that sinkhole is barely going to get deeper.

In line with the meta:

“We count on full-year 2024 complete spending to be between $96-98 billion, up to date from our earlier estimate of $96-99 billion. For Actuality Labs, we count on 2024 working losses to extend meaningfully year-over-year attributable to our ongoing product growth efforts and investments to additional scale our ecosystem. We count on our full-year 2024 capital expenditures to be within the vary of $38-40 billion, up to date from our earlier estimate of $37-40 billion.”

As well as, Meta expects “important capital expenditure progress in 2025” as it really works to construct new AI datacenters and different infrastructure for its next-level initiatives.

Meta is arguably main VR, AR And AI growth, primarily based on its huge knowledge base, years of growth on associated initiatives, and sources at its disposal. However this comes at a value, and whereas Meta has but to eat these prices, none of those initiatives have but introduced in significant income for the corporate.

However they’ll. Effectively, hopefully.

The Mate AR glasses are set to be successful with the corporate showcasing its new AR machine at its Join convention final month.

In some unspecified time in the future, practical AR goes to develop into a factor, and Meta, at this level, appears poised to win when it catches on and turns into an enormous pattern. And with its present Ray Ban sensible glasses gross sales booming, indicators counsel that shopper demand for AR glasses will likely be important.

Metaverse remains to be lingering as a long-term play, and Meta is clearly paving the best way for VR growth, whereas its AI initiatives are additionally gaining traction, with Zuckerberg as soon as once more praising his adoption of AI chatbot, which he says is now essentially the most extensively used AI chatbot instrument available on the market.

The truth is, in his pre-release assertion, Zuckerberg attributed the corporate’s sturdy efficiency to progress and momentum round “meta AI, llama adoption, and AI-powered glasses.”

A few of these stay speculative bets, however the indicators are there, they usually all level to changing into the brand new norm for connectivity and interplay within the close to future. It could be laborious to think about everybody interacting in a VR headset sooner or later, however the progress is comprehensible, and AI can play an vital position in that have, serving to customers create their very own customized VR worlds.

As such, Meta’s present AI instruments appear pretty generic, and do not add a lot to IG’s Fb experiences (the rising use of its AI chatbot might be extra indicative of Meta’s scale than the bot’s recognition), I do not assume so both. Not that that is a lot of an indicator that the meta is transferring ahead.

So, a very good final result for Meta, or not less than, a largely anticipated final result, is that its advert enterprise will stay sturdy and its growth prices excessive. I doubt there will likely be a significant market backlash in opposition to the corporate, even with these projections of additional price will increase, as the longer term stays fairly rosy for the enterprise.

However compounding prices will scare off some traders, which might immediate a short-term relax.