Meta introduced its newest earnings numbers, together with the primary broadcast of its revised efficiency abstract, which reduces the quantity of perception accessible from firms and goals to supply a extra complete abstract of its firm knowledge.

The target right here could also be to cut back market scrutiny, refocusing on knowledge factors that Meta thinks will mirror extra positively on its enterprise. But it surely’s extra limiting for analysts, as most statistics take a distinct perspective than conventional reporting.

First off, on the customers. Meta now solely shares combination utilization statistics, masking the whole ‘household’ of apps (Fb, Messenger, Instagram and WhatsApp), so we do not get breakouts of Fb utilization particularly.

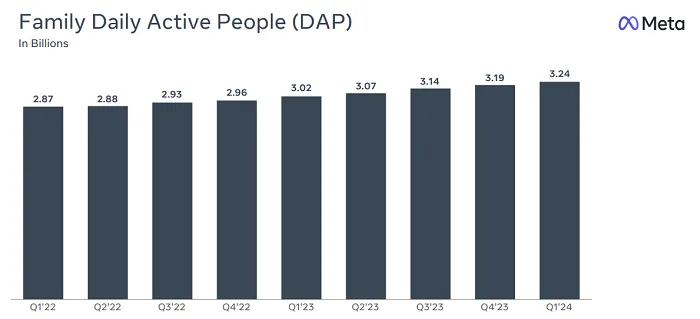

And presently, Mater Household Day by day Lively Folks (DAP) is 3.24 billion, which has elevated from 3.19 billion in its final report.

Apparently, Meta did not even present month-to-month energetic person numbers, so we now solely have knowledge for each day energetic customers, throughout all its platforms.

This looks like a step again when it comes to transparency, as there isn’t any strategy to break down development in every app or not. However Meta is clearly assured that its variety of each day energetic customers is probably the most indicative of its efficiency, and the 7% year-over-year improve in each day actives is an indicator of its continued success.

Though it’s primarily based on the expansion in WhatsApp or IG, we have no idea, however maybe, WhatsApp, which is gaining momentum in Western nations, has change into the reason for extra curiosity, whereas Fb is rising in growing markets, as was the pattern.

When it comes to income, Meta introduced in $36.46 billion for the quarter, a 27% year-over-year improve.

As you may see on this breakdown, Meta remains to be closely depending on the US marketplace for its advert consumption, so whereas it is rising in rising areas, they’re nonetheless not bringing in equal income.

But it surely bodes nicely for future alternatives, and in contrast to Snapchat, which has seen sturdy person development, however much less income development, Meta is well-positioned to have the ability to capitalize on these alternatives sooner or later, because it continues to strengthen its earnings and develop its high line. happening enterprise

Meta additionally included a brand new chart – “Advert Impressions Delivered.”

Logically, the extra customers Meta has, the extra adverts it might present, and this chart goals to supply perception into how its advert enterprise is performing total, indicating future alternatives for development, significantly in growing markets.

It is also attention-grabbing from an app utilization perspective. WhatsApp and Messenger have fewer advert alternatives, so their relative development is much less beneficial on this regard, whereas Fb and IG present extra advert publicity. As such, the numbers might be seen as some indication of the relative development of every platform inside every area.

Meta’s shared this overview of “Common Family Revenue Per Particular person,” which exhibits how these advert impressions translate into actual cash.

So principally, as an alternative of specializing in total person development, Meta is attempting to refocus the market on its potential alternatives, by exhibiting that its advert enterprise is working to ship extra adverts to extra folks, even in areas which have a variety of income. is just not Enterprise.

In previous experiences, Meta’s “common income per person” chart confirmed how a lot it was making by area, however this extra generalized show appears to be like higher for the corporate, shifting away from precise money consumption to development.

It is a sensible transfer by Meta to reframe its metrics, although once more, it reduces the general perception accessible into its efficiency.

One other key space of focus is its ongoing funding in Metaverse-related initiatives, with its Actuality Labs VR division nonetheless dropping billions each quarter.

As you may see on this overview, Actuality Labs’ meta spend throughout this era was $3.8 billion, whereas gross sales of VR headsets solely elevated marginally over time.

Meta famous that gross sales of its Ray Ban sensible glasses are rising, which could possibly be one other issue serving to Actuality Labs’ income develop. However for now, Metaverse stays an costly long-term guess, which might see Meta make investments one other $15 billion in 2024.

Meta has spent greater than $17 billion on VR improvement in 2023 and has invested greater than $46 billion within the venture since 2021. It is an costly and due to this fact dangerous guess, however Meta’s total sturdy income efficiency ought to mitigate any scrutiny on this materials.

When it comes to future projections, Meta says its prices will proceed to rise Because of ongoing investments in AI and VR.

“Whereas we’re not offering steerage past 2024, we anticipate capital spending to proceed to extend subsequent yr as we aggressively make investments to help our bold AI analysis and product improvement efforts.”

Earlier this yr, Meta CEO Mark Zuckerberg outlined his plans Earn 350,000 Nvidia H100 GPUs to create its next-generation AI, which might really mimic human-like intelligence. Complete funding within the venture will doubtless exceed $10 billion this yr, and is separate from ongoing VR improvement.

Meta offsets a few of these prices by decreasing headcount via employees rationalization (Meta says staffing ranges are down 10% yr over yr). However principally, Meta goes to take a position loads, subsequent yr at the very least, in long-term bets. So principally, Meta is now making ready the marketplace for a giant improve in spending, which can have an effect on its immediate-term outlook.

General, it is one other good report card for Meta, exhibiting that its core enterprise is strong, and that it is nonetheless seeing relative development in app utilization, even when we do not see which apps particularly are getting extra consideration.

However AI and VR predict disruption primarily based on the funding required in computing.

Most would agree that it will be cash nicely spent, particularly as its VR imaginative and prescient turns into clearer. But it surely may be a rocky interval, particularly if there’s a important downturn in its advert enterprise.