Snap Inc., the dad or mum firm of Snapchat, launched its newest efficiency replace, displaying improved income efficiency and continued development in customers, as it really works to get parts of its enterprise again on monitor.

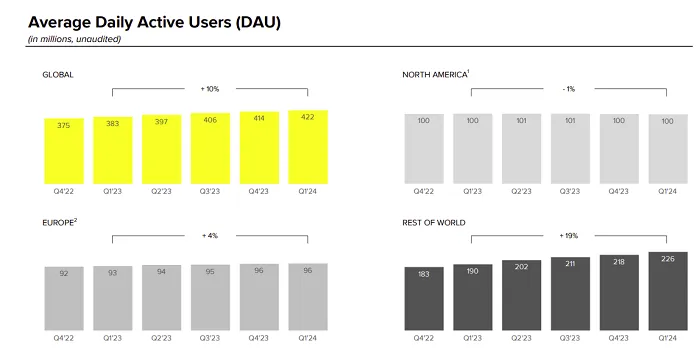

First, by way of customers. Snapchat now has 422 every day actives, a rise of 8 million customers over the earlier interval.

Which is nice, however the worrying signal for Snap is that it is nonetheless not gaining traction in its core income markets, with utilization within the US and EU remaining flat within the meantime.

Gaining extra customers in rising markets is essential to future development prospects, as extra customers equals extra alternatives. However on the identical time, these areas at the moment usher in nowhere close to as a lot income for apps.

As you’ll be able to see in these charts, Snap brings in additional income from its US viewers and practically double the ARPU from European customers because the “remainder of the world” phase.

That is why in its final replace, Snap talked about that it’ll focus extra on rising its US and EU viewers versus different areas, however up to now, not less than it hasn’t had an impression on consumer development.

When it comes to particular conduct, Snapp says that tWhole time spent watching its TikTok-like highlight video feed grew greater than 125% 12 months over 12 months. This underscores the importance of TikTok’s affect within the bigger social media panorama, and why some imagine Snap is poised to take a leap if TikTok ultimately exits the US.

In 2020, when TikTok was banned in India, Snapchat was certainly a giant winner, successfully doubling app downloads within the area. It is a a lot totally different scenario within the US although, and this was earlier than the arrival of Instagram reels and YouTube shorts, so it is unlikely to see the identical sort of bump this time round.

Nevertheless it may get extra consideration, although I might nonetheless count on TikTok to proceed within the US, in some type, after the funding deadline.

Snap additionally famous that its “Snap Stars” program, which presents extra options to authorized, excessive profile creators, has helped drive better engagement with complete time spent viewing Snap Stars’ tales rising by greater than 55% year-over-year in North America. America.

In line with Snap:

“We onboarded greater than 1,500 Snap Stars in Q1, which helped drive quarter-over-quarter development in story posts, highlight posts and story time for Snap Stars globally.”

The initiative goals to maintain these excessive profile creators posting on the app, and it appears to be having a optimistic impression on engagement.

When it comes to income, Snap has introduced in $1,195 million for the interval, a 21% year-over-year enhance.

Snap says enhancements to its machine studying mannequin are main to raised outcomes for its promoting companions, with small and mid-sized advertisers specifically benefiting considerably.

“In First 1, ongoing momentum with our 7-0 pixel buy optimization mannequin – which allows advertisers to bid for 7-day clickthrough conversions – led to a greater than 75% year-over-year enhance in purchase-related conversions. We in Q1 Expanded 7-0 optimization to app installs and app purchases and can develop testing of extra app targets in Q2, together with our means to help worth optimization and customized occasion optimization.

Considerably surprisingly, Snap additionally says the variety of small and medium-sized advertisers on the app has grown by 85% 12 months over 12 months, which it attributes to its simplified advert creation course of.

I imply, it is a massive bounce, and it will be attention-grabbing to get extra perception into how Snap made such a giant bounce in adoption.

Snapchat additionally famous that Snapchat+, its subscription providing, now has 9 million paying members, up from 5 million in September final 12 months. Snap added an choice to present Snapchat+ memberships again in December, and it appears to have had an impression on take-up over the Christmas interval.

Which means, at $3.99 per member, Snap is now making about $35 million monthly from Snapchat+. That is nonetheless a fraction of its complete advert income ($100 million per quarter), nevertheless it’s a helpful extra income stream, which additionally exhibits how subscription social can work inside sure parameters and contexts.

Trying forward, Snap says it expects to succeed in 431 million every day lively customers in Q2, with income steering of between $1,225 million and $1,255 million, or 15% to 18% year-over-year development.

These are good numbers for Snap, particularly after its less-than-surprising This fall efficiency replace. And whereas it nonetheless has a technique to go to get its enterprise again on monitor, the outcomes right here counsel it’s specializing in the appropriate areas, which is able to assist deliver in additional income from its core income areas.